Incoterms and the transfer of risk

It is necessary for an individual to decide whether to retain risk or endeavour to transfer it to the other party. The most common form of risk transfer is by means of insurance which changes an uncertain exposure to a certain cost, i.e. premium that can be budgeted for. In normal circumstances insurance premiums include provision for insurers’ overheads and profit plus contributions for the catastrophe element. When dealing with Incoterms, every individual, company or government department is exposed to a wide range of risks. It is inevitable, by nature of probability that financial loss will occur sooner or later. The Incoterm you select for a particular situation should assist you in minimising the risk exposure for your company and in the most cost effective manner available

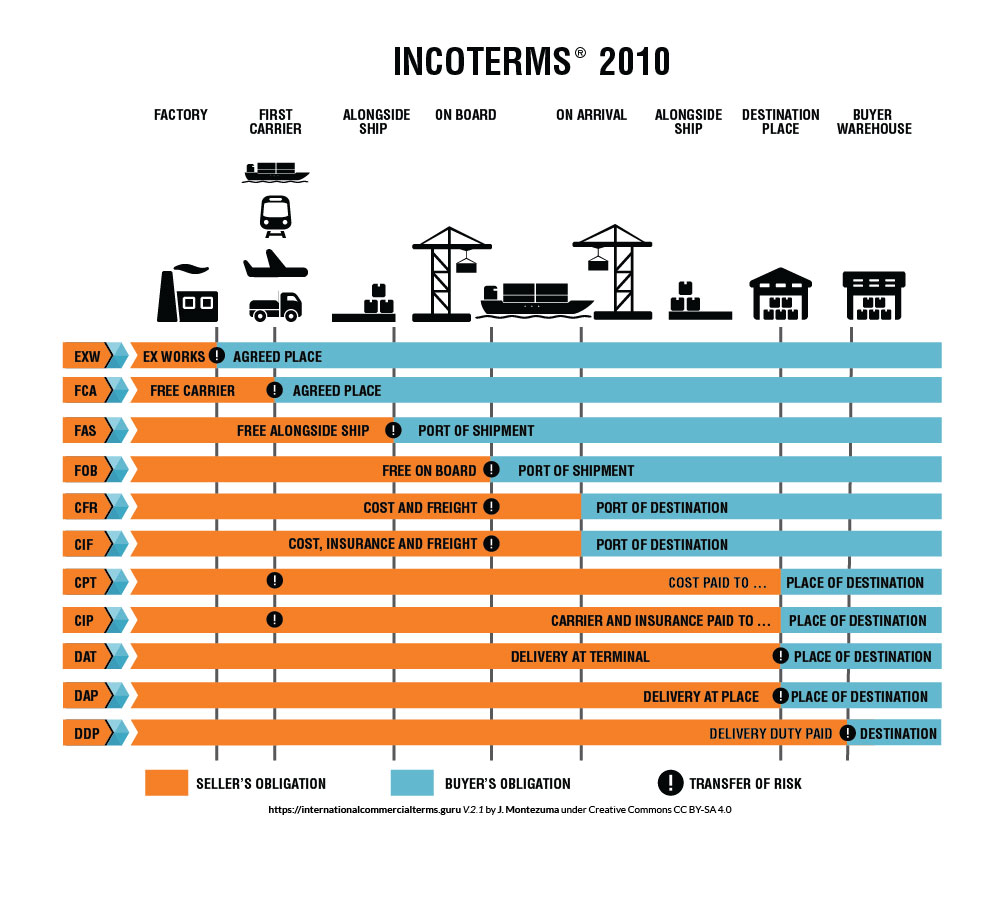

Incoterm Transfer of risk

EXW When the goods are at the disposal of the buyer

FCA When the goods have been delivered to the carrier at the named place

FAS When the goods have been placed alongside the ship

FOB When the goods are on board vessel, at the port of export (origin)

CFR When the goods are on board vessel, at the port of export (origin)

CIF When the goods are on board vessel, at the port of export (origin)

CIP When the goods have been delivered to the main carrier, at the port of export (origin)

CPT When the goods have been delivered to the main carrier, at the port of export (origin)

DAT When the goods once unloaded from the arrival means of transport and are placed at the disposal of the buyer at a named port or place of destination

DAP When the goods are placed at the disposal of the buyer on the arriving means of transport and ready for unloading at the named place of destination

DDP When goods are placed at the disposal of the buyer having been cleared for import and ready for unloading at the named place of destination.

Contracts and the use of the Incoterms 2010 rules

It is critically important during the tendering process, depending on the type of sourcing, whether strategic, tactical or project, that the terms of sales be discussed upfront and at every stage of the contract-formulation process. More importantly, all stakeholders should be aware of both the advantages and the disadvantages of each Incoterm in order to be able make appropriate decisions when dealing with international trade transactions.

The following have to be noted before concluding and signing a contract

(this is a requirement introduced by the Incoterms 2010 rules):

Common errors made by importers and/or exporters in the use of Incoterms in contracts

Despite the fact that Incoterms were developed to simplify international transactions and to make their application in international trade more precise, there are still a number of reasons why they often fail to achieve their intended purpose. In most cases, it is due to lack of knowledge of the terms as well as inaccuracy and even too little effort put in when utilising or applying them. The following have been identified as the problems most frequently associated with use of Incoterms:

1.Most people use a sea-freight term such as FOB or CIF when consigning goods by air or road freight.

2.Incoterms are not quoted at all in the contracts. This makes it very difficult to apportion responsibilities to either the buyer or seller and even to manage and/or monitor these contracts

3.Doing more under the term than required, for example, loading under ‘Ex-Works’.

4.Out-dated Incoterms being used. Many people are not aware that a new version of the Incoterms was issued in January 2010 and that some original Incoterms—such as DDU, DES DAF and DEQ—are no longer in use. Many, however, still continue making use of them. Worse still, one may find that an Incoterm is quoted followed by 2000 instead of year 2010 or no year at all. Although, in a few cases, this may not mean much difference when considering the obligations, but in certain cases, for example FCA, there are very significant differences and the use of the wrong edition can be critical.

5.Incorrect abbreviation of the Incoterm are being quoted. One will occasionally come across situations where the invoice does not indicate the full Incoterm. For example using Ex-works instead of EXW and while it may still be possible or logical to work out which Incoterm was involved it should be pointed out the seller or buyer that the correct version always has three letters

6.Not being protected against when things go wrong because the ‘term’ quoted has never been reviewed against the legal issues. In practice, some contracts have quoted the unrecognized Incoterms such as Delivered Cost Included (DCI) or Delivery Cost Excluded (DCE). This is dangerous as these terms are not recognized by legal authorities and therefore using these terms might lead a company having no recourse should a dispute arises out of the use of these unrecognized or illegal terms.

7.Parties choose the wrong Incoterm for their particular trade. It is common practice that some people use DDP, when the seller is unable to meet the registration requirements of overseas customs authorities.

8.Parties fail to reference the Incoterm with sufficient clarity. The issue of precision where lack of familiarity with the terminology results in terms such as: FOB South African port being quoted or shown. This will result in all the relevant costs covered by the Incoterms rule being included. While this may be due to the parties wanting to cover all eventualities, it is critical for the preparation of the quotation or estimate that the exact port is known when working out the transport costs

9.The mode of transport not taken into consideration. Certain shipments are more suited to a particular Incoterm, owing to the method/mode of transport used. It is therefore critical, when, if the way in which the cargo is transported changes, then the existing Incoterm should be reviewed for suitability. With the advent of multi-modalism there are certain commodities and cargo that are now being containerised which were previously transported as break-bulk.

10.Resistant to change—conservatism. Sellers may have used terms such as FOB or DDP for several years without an issue and it is not easy to convince clients that they are using an inappropriate or unsuitable Incoterm until an issue arises and a loss is suffered.